capital gains tax canada 2020

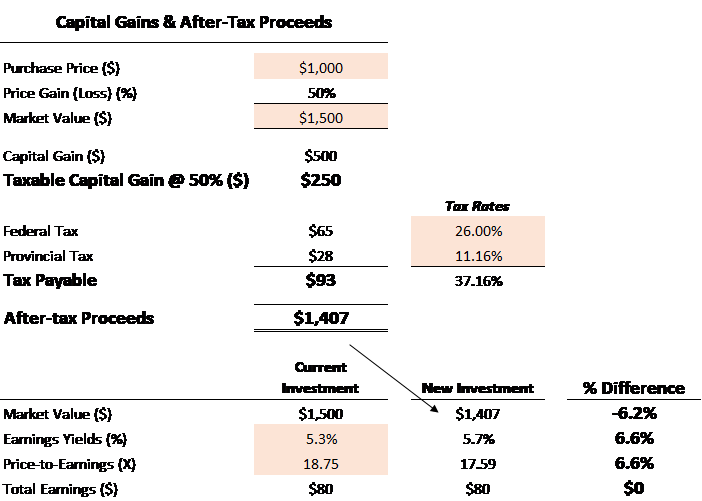

If you earned a capital gain of 10000 on an investment 5000 of that is taxable. The inclusion rate for personal.

2022 Canada Income Tax Calculator Turbotax Canada

The things you need to know to calculate your gain or loss like the inclusion rate adjusted cost base ACB and proceeds of disposition.

. A Capital Gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the. And the tax rate depends on your income. For best results download and open this form in Adobe ReaderSee General information for details.

The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22. Dividends distributed within taxable periods commencing after. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

For more information see Losses and deductions. Completing Schedule 3 Completing the applicable. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

What is Andrews taxable capital gain for. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. For a Canadian who falls in a 33 marginal.

Schedule 3 is used by individuals to calculate capital gains or losses. You can apply 12 of your capital losses against any taxable capital gains in the year. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

For people with visual impairments the following alternate formats are also available. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high.

In Canada 50 of the value of any capital gains are taxable. Because you only include one half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 12 of a LCGE of. On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to. New Hampshire doesnt tax income but does tax dividends and interest.

If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately. You may be entitled to an inclusion rate of zero on any.

Canada Corporate Tax Rate 2022 Data 2023 Forecast 1981 2021 Historical Chart

Misunderstandings About Capital Gains Taxes Fraser Institute

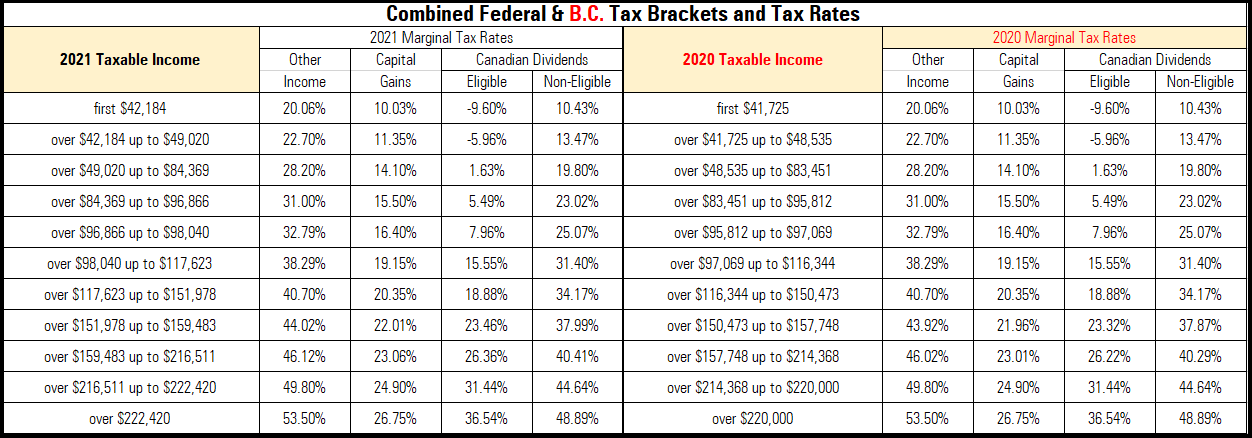

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Investing Series How Does The Capital Gains Tax Work In Canada Save Spend Splurge

How To Avoid Capital Gains Tax In Canada Zolo

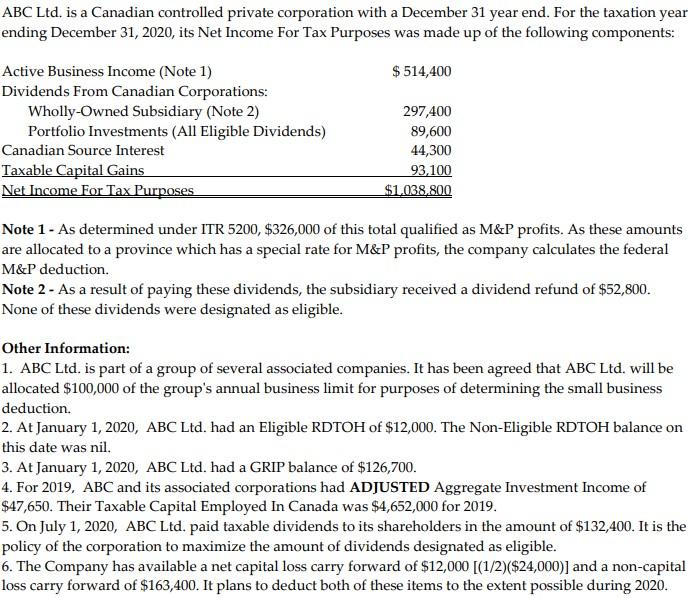

Abc Ltd Is A Canadian Controlled Private Corporation Chegg Com

Corporate Tax Rates Around The World Tax Foundation

Reporting Capital Gains Dividend Income Is Complex Morningstar

Capital Gains Tax Rate Rules In Canada What You Need To Know

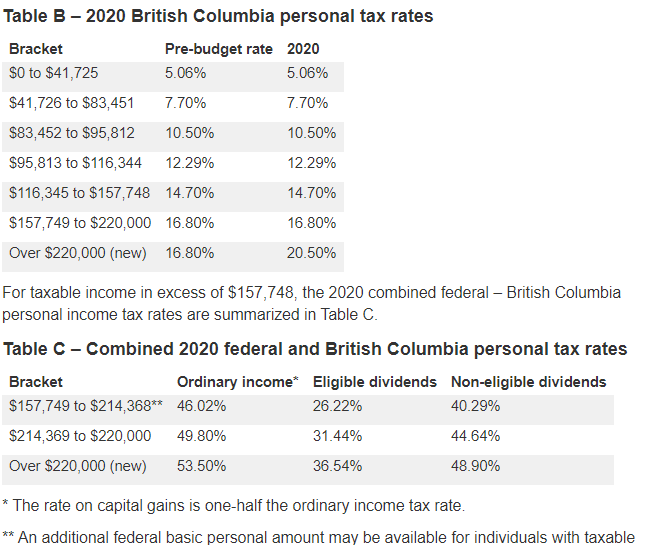

Canada British Columbia Issues Budget 2020 21 Ey Global

Capital Gains Tax Calculator For Relative Value Investing

How Is Capital Gains Tax Calculated On Real Estate In Canada Srj Chartered Accountants Professional Corporation

6 Capital Gains Tax Myths Debunked Zolo

Second Career Search Take Advantage Of The Lousy Market

How Much Tax Will I Have To Pay On Cerb Consumer Credit Counselling

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)