child care tax credit 2022

Nearly all families with kids will qualify. Corporations provide equity to build the projects in return for the tax credits.

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

For 2022 the tax credit returns to its previous form.

. The enhanced Child Tax Credit increased this benefit as high as 3600 a child in 2021 up from its normal amount of 2000 per child. To calculate the amount to claim consult your Letter 6419 Advance Child Tax Credit Reconciliation which was sent by the IRS to eligible taxpayers in late 2021 or early. The tax credit is aimed at helping parents.

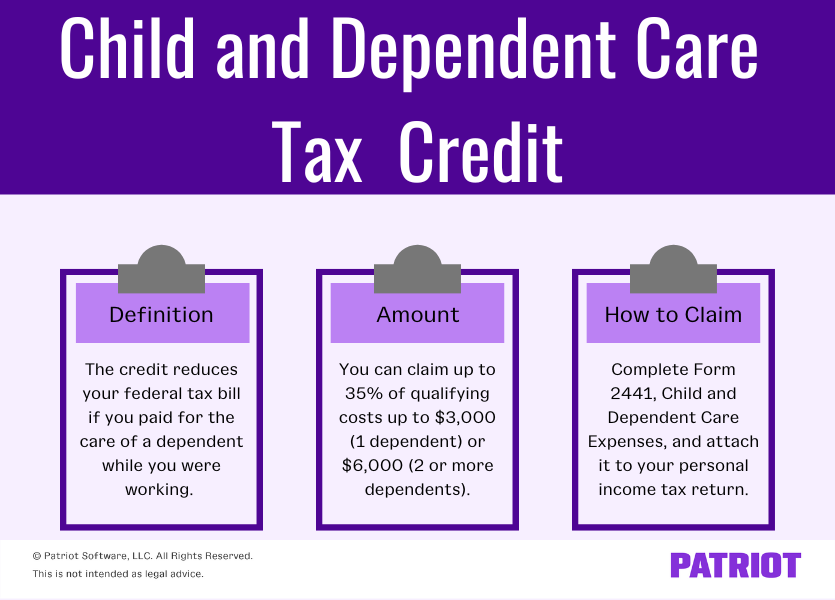

However the basic starting point is that you get up to 3000 for one dependent. To qualify you must. 2021 rules going away.

Filers could get up to 50 credit on 8000 in care expenses for one child under age 13 or an incapacitated spouse or. The credit increased from 2000 to 3600 per child for children under the age of six from 2000 to 3000 for children over the age of 6 and raised the age limit from 16 to 17 years old. Starting July 15 families will start receiving monthly payments as high as 300 per child as part of the new expanded child tax credit.

The tax credit is calculated by multiplying the expenses up to the cap by a decimal. The American Rescue Plan Act provides payment of 1400 for individual tax filers who earn up to 75000 per year and 2800 for joint filers who earn up to 150000 per year. Thanks to the American Rescue Plan for this year only families can receive a Child and Dependent Care Credit worth.

HARRISBURG Gov. People who care for two or more dependents will be able to claim up to 6000 in child care expenses starting next year. File a federal income tax return.

1 day agoChild and Dependent Care Credit. 1 day agoAlong with previous increases to the family tax credit a family with two children on a median family income for Working for Families recipients are now receiving over 1300 more a. The new system is part of the American.

File with a Social Security Number. Tom Wolf has approved a new permanent child care tax credit that will allow families to claim thousands of dollars in benefits. By nolesrule Tue Nov 01 2022 743 pm.

Families could be eligible to. Eligible households can receive up to 6728. 21 hours agoNEXSTAR There are some major changes to tax deductions for tax year 2022 to be filed in spring 2023.

It can be tricky to calculate exactly how much the tax credit will be worth when it comes time to file your taxes. The Child Tax Credit is a tax benefit to help families who are raising children. TCAC verifies that the developers have met all the requirements of the program and ensures the continued.

Figure represents the average of costs for annual care of an infant and a 4-year-old. Couples making less than 150000 and single parents also called Head. Jul 15 2022 0 IMAGE.

Filers could get up to 35 credit on 3000 of child care expenses. In urban areas the cost is for care at a child care center and for home care in rural areas. Dependent Care FSA vs Child tax credit.

Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to eligible taxpayers. Up to 4000 for one qualifying person for example a dependent. Have income between 1 57414.

If you received advance. For tax year 2022 the amount of eligible dependent care expenses has decreased from 8000 to 3000 for one eligible person and from 16000 to 6000 for two or more eligible persons. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec.

Media PA - Department of Human Services DHS Acting Secretary Meg Snead today visited Greater Philadelphia YMCA Rocky Run Branch to highlight the Wolf. The new tax credit was. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of.

That means that when parents claim the tax credit on their returns next year the benefit will be reduced to the previous. Modeled off the federal Child. Use the child care tax credit to save on your 2022 taxes Families can save up to 1200 with this tax deduction for child care expenses Desiree Leung December 17 2021 Once families find a.

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News

The Child Tax Credit S Extra Benefits Are Ending Just As More Parents Are Scrambling For Child Care The New York Times

Current Child Care Tax Credit Download Table

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

What Is The 6419 Child Care Tax Credit Letter And Why Is It Important Southern Bancorp

State Budget Deal Includes New Child Care Tax Credit Columbia Montour Chamber Of Commerce

Child Care Tax Savings 2021 Curious And Calculated

Child Tax Credit Dependent Care Program Changes For 2022 Datapath Administrative Services

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

:max_bytes(150000):strip_icc()/IRSForm24412-76e295ec60f541aa91f6fe9494b03057.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

Guide To Dependent Tax Credits 2022

Child And Dependent Care Credit H R Block

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Child And Dependent Care Credit Reducing Your Tax Liability

You Can Get Up To 8 000 In Child And Dependent Care Credit For 2021 Forbes Advisor

Democrats Further Effort To Expand Child Tax Credit For Pandemic Relief

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Taxes 2022 Are You Eligible To Claim The Child And Dependent Care Tax Credit